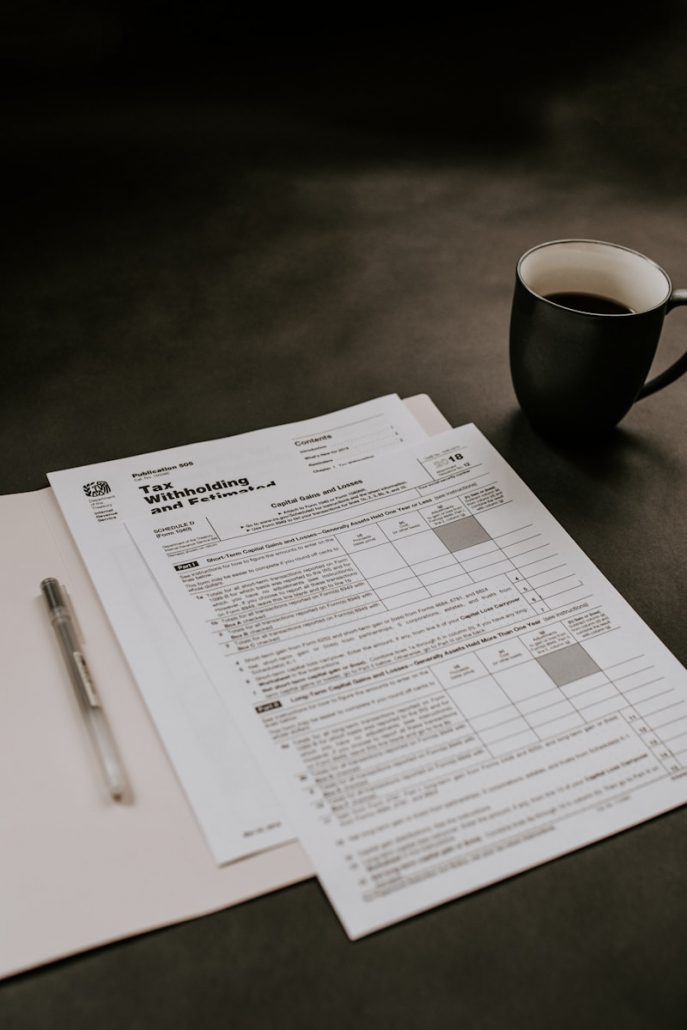

Federal Tax Policy Changes for 2026 Impact Charitable Giving

There are several changes that have come for 2026 that will have an impact on donor giving for 2026 and we want to share some of these with you as you make plans for your charitable gifts this year! Please note: this should not be considered tax advice and you ought to consult with someone to better understand these impacts to your giving for the year.

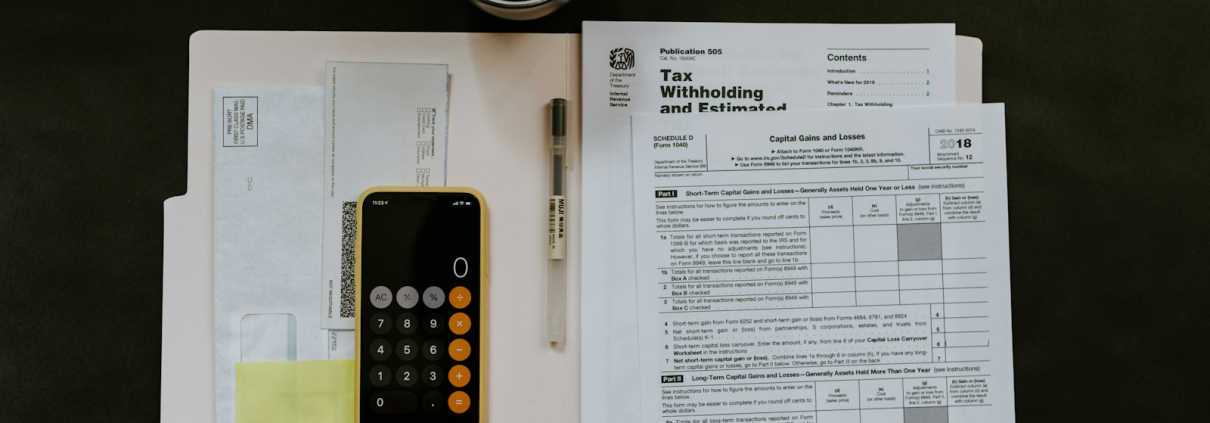

Universal Charitable Deduction (UCD)

Back for 2026, anyone filing a tax return will be able to deduct $1,000 (single filer) or $2,000 (married, filing jointly). The UCD was part of tax policy until about 1986. It returned during COVID for a couple years where someone could deduct $300/$600 (respective of single or married filing jointly) even if a person didn’t itemize. Again, this applies to all donors at any level and the amounts are higher for 2026.

New “Ceiling” and new “Floor” as it relates to charitable giving

The way that the new ceiling works is that anyone who is at the top federal tax rate of 37% can now itemize as if they were at the 35% level. The floor means that people who are not in that 37% cannot deduct the first 1/2 of 1% of their adjusted gross income (AGI). Essentially, the ceiling and floor only apply to individuals making around $650k and married filing jointly at $725k.

2025’s SALT (State and Local Tax) Deduction

Lat year, there was a change to the State and Local Tax deduction whereby in 2017 the limit went down to $10,000. That limit changed last year to $40,000. The Fundraising School’s research shows that charitable giving is strongly linked to itemization. Essentially, the more people are able to itemize, the more that they give to charities.

Business Sector Giving

There are additional rule changes to business sector giving. Soccer Chaplains United does not currently have business sector donors, so suffice it to say if this area is a topic of interest, you might want to research it.

A helpful podcast that is less than 15 minutes long can be found here and most of this information in this post has been derived from this podcast.

Thank you as you consider your donations and support of Soccer Chaplains United for 2026. Please let us know if you have any questions.

You can give a safe, secure, electronic, tax-deductible gift via PushPay by clicking the button below or by texting soccerchaplains to 77977. You can also mail a donation to Soccer Chaplains United, PO Box 102081, Denver, CO 80250. Soccer Chaplains United is a 501(c)3 non-profit organization